Before reviewing this section, note that the strategy below helps to hedge a portfolio against a somewhat gradual move downwards. This price movement is common in a normal bear market. This strategy will NOT be nearly as effective during a massive spike in volatility when markets are crashing rapidly. To guard against these type of events, we use what we call our 3-5 Black Swan Hedge strategy. This can be found at the link below:

Overview:

Let’s begin with the two main goals of hedging our portfolio:

- Create trades that will help mitigate the effects of large unexpected moves in the market thus increasing sustainability.

- Do so without straining profitability so much that we miss our monthly targets.

We hedge our portfolio because bad things inevitably happen. We could go on making 30%, 40%, 50% profit every year without hedging but at some point, the market will take an unexpected dip that can potentially wipe out an entire year or even more of profitable trading. These events occur more often than we realize. Selling a 5 delta /ES put seems like a guaranteed win but it is absolutely not. There is never reward without risk and as premium sellers we are taking on a large amount of risk. Without proper hedging, this can easily be our downfall.

What positions do we hedge?

We hedge positions for which a large market move that triggers stops on most or all of our positions on a particular futures product would cause our account to take on losses in excess of 10%. For example, we almost always hedge our /ES positions because they generally make up a good portion of our entire portfolio. A large sudden drop in /ES futures would cause stops on many of our /ES positions causing our portfolio to take on heavy losses. On the other hand, products that represent a smaller portion of our portfolio may not need to be hedged if triggered stop losses would fail to cause our total liquidity to drop by over 10%. For example, let’s say in a $50,000 account we have only a single trade running on /CL with a stop loss at -$2000. If triggered, this trade would represent a -4% drop in net liquidity. For this reason it does not need to be hedged.

While hedging is crucial to sustainability, we also want to make sure we aren’t over-hedging to the point where we are causing excessive drag on our profits. We could easily just buy far out of the money puts but that might not be the most efficient way to protect from downside risk.

We prefer to calculate how much protection we need and then work our way backwards when hedging. From here forward, we’ll describe how we hedge our /ES positions specifically. Our typical approach is to figure out what a 10%+ market drop within the span of a month would do to our current positions. In many cases, a 10% drop within 1 month may trigger stops on virtually all of our /ES positions. If that’s the case, we need to calculate out how much exposure we have by calculating how much of a liquidity loss would occur if this were to happen. It should also be noted that these calculations are done assuming we can hit our stop losses precisely at our designated levels. If a black swan event occurs, it may be difficult to hit our stop losses exactly where we intend to.

Here’s an example to show how to calculate exposure of our /ES positions:

-Five open 112 positions each with a stop loss of -$3500 each = $17500 in exposure

-Two open strangle positions with a stop loss of -$2000 each = $4000 in exposure

By adding the total exposure together we see we have the potential to lose $21500 if all of our /ES positions were stopped out.

From here, we need to decide how much of that we want to provide coverage for. In most cases, we do not buy protection to cover 100% of stop losses. We expect to take on some degree of loss if markets take a sudden dip. We also tend to have on multiple put debit spreads left over from our 112 positions from which we have taken the naked puts off. These trades provide us additional protection which has already been paid for.

Let’s say that using the above example, we wanted to buy a hedge that would pay out just $15,000 from a 10% drop in the market over the span of 1 month. We would look to open one or multiple debit spreads 1 month out with the long strike at around 10% below current market levels.

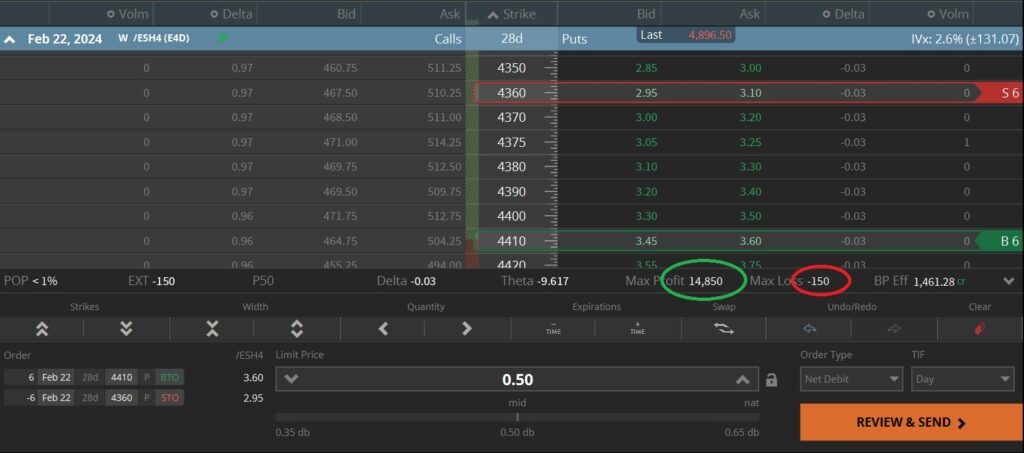

As of writing this, /ES futures currently sit around the 4900 level. The strike 10% below current prices would be 4410. This would be our long leg. The width of the trade depends on how many contracts you want to buy to fulfill a potential $15,000 gain. For this example we’ll use the 4360 short strike for a 50 point wide put debit spread. A single spread at these levels would cost around $25 plus commissions and it would pay out $2500 at max profit. To reach $15,000 in protection, we would need to buy 6 of them.

6 x put debit spreads @ $25 each = $150 initial debit which will pay out ~$15,000 if the market closes below 4360 at expiration. Below is a screenshot of this particular trade set up on Tastytrade, our preferred trading platform. Open a Tasty account using the link here:

Using put debit spreads can be a relatively cheap way to provide a large amount of protection from large market downturns. The values shown above are purely an example of what can be achieved. In practice, this trade can easily be adjusted to provide more or less protection based on your own strategy.

NOTE: This is not financial advice. All content on this website is for entertainment purposes only. All followers are responsible for their own actions when investing. Talk to a licensed professional before making financial decisions.